“We had been challenged a number of times in changing our underlying CRM platform. After implementing SAFe, our overall effort actually came in $12M less than originally estimated and 18 months sooner than predicted.”

—Bryan Kadlec, Director, Client Digital Experience

Challenge:

Market leader Northwestern Mutual sought to apply Lean-Agile practices to remain competitive, though previous efforts had been stymied by a longtime Waterfall culture.

Industry:

Financial Services, Insurance

Solution:

SAFe®

Results:

- Collection Feature Cycle Time improved 30-50%

- IT delivers requested capabilities 80-90 % of the time

- The overall effort on a project came in $12 million less than originally estimated and 18 months sooner than predicted

Best Practices:

- Support experimentation—Leadership at NWM fostered an environment, and provided resources, to enable this transformation. “Our forward-thinking leadership knew we needed to bring in some changes so they invested in continuous learning and improvement,” Schindler says.

- Use proxies for offshore teams—NWM pre-plans with offshore teams and then brings proxy representatives to PI planning events.

- Customize SAFe—NWM increased engagement with its own spin on the program board, with the Transformation Railway Station.

Introduction

In business, staying ahead of the competition inevitably requires taking some risks. But how do you do this, when a key part of your success depends on keeping risk at bay? That’s the question Milwaukee-based Northwestern Mutual (NWM) had to answer while seeking new ways to maintain and build on their 160-year history of helping families and businesses achieve financial security.

To maintain the leadership position NWM has built over nearly 160 years, the organization has taken an innovative, entrepreneurial approach to business. It’s paid off: The past year (2016) was one of the company’s strongest. The company reported record-level revenue ($27.9 billion), was named by FORTUNE® magazine as one of the “World’s Most Admired” life insurance companies, and has maintained the highest financial strength ratings awarded to any U.S. life insurer.*

300-Day Cycles

In 2012, the company reached a turning point. In addition to a company-wide push for continuous learning and improvement, IT needed to move faster.

“It took over 300 days and many instances to deliver value to our customers,” says Jill Schindler, Manager, Client Digital Experience. “We were getting a lot of questions around, ‘Why does it take so long and cost so much?’ We knew we needed to be more flexible, adaptable and responsive, and it didn’t take us long to realize that Agile was a big part of that.”

NWM had tried to adopt Lean-Agile practices before, experimenting with a few Scrum teams in the mid-2000s. However, those efforts ran headfirst into a deeply ingrained Waterfall culture.

“We didn’t start with much training or coaching, and teams worked on the aspects they wanted instead of the aspects that we needed,” says Bryan Kadlec, Director, Client Digital Experience. “We fell woefully behind and then were slammed by a waterfall world to put out the fire.”

A Second Attempt at Agile

Northwestern Mutual shelved its Scrum efforts until 2012, when the company embarked on a more methodical approach to Agile. This time, they set out to train as many people as possible. “We wanted to do this and senior leadership believed in it, so we pushed forward,” Schindler says.

At the time, three or four teams experimented with Agile but the organization simply was not set up to accommodate it.

For next steps, they held their first rapid improvement event (Value Stream mapping). The weeklong event brought together Scrum teams and specialized teams with the goal of addressing the challenges of these distinct groups working together. The end result: a better understanding of the problems and a systematic way of approaching them. Key to that was engaging the IT strategy team to help remove barriers.

The Missing Piece

About that time, NWM found the Scaled Agile Framework® (SAFe®) and quickly saw it as the missing piece. “SAFe totally lines up with what we were already trying to do but we just didn’t have a platform for it,” Schindler says. “This was the framework we needed for delivering Agile at scale.”

“In SAFe, we could see Agile and Lean together and had this sense that it was a very powerful thing,” Kadlec adds.

Schindler and Kadlec went back to the leaders of their respective organizations and secured resources to try SAFe—becoming pioneers not just for their own company, but also establishing NWM as the first large company in Wisconsin to take this course. They believed firmly in their chosen path, but it still felt risky to apply new Lean-Agile practices to a large chunk of the company’s portfolio.

“It shaved a few years off our lives!” Kadlec quips. “We believed that the path we were taking would deliver high value, but it still felt high risk. But if we’re going to compete, we had to have a quicker response time.”

The First Program Increment (PI)

Schindler and Kadlec trained as SAFe Program Consultants (SPCs) and additionally tapped Al Shalloway, CEO, Net Objectives, along with SAFe Fellow Jennifer Fawcett to facilitate the company’s first PI planning event. NWM asked 270 people to come together for the first two-day event—in January in Wisconsin—where they launched their first four Agile Release Trains (ARTs).

The response was heartening. People were engaged and ultimately on board. “At the end of the day, we felt a huge sense of accomplishment,” Schindler says. “Everyone understood what was expected of them.” Northwestern went on to train as many people as possible. In fact, for some team members, training was the first sprint.

Making the shift in the company’s longtime waterfall culture wasn’t easy. Coaching was key, especially at the beginning. As teams went through cycles of Plan, Do, Check and Adjust, old behaviors would emerge—and need to be addressed. In truth, some individuals chose to leave—but most chose to dedicate themselves to the new way of working. The “new era” behaviors the Agile mindset fosters have taken such a firm hold companywide that they are now a factor in performance reviews.

By the second PI event, again with Fawcett facilitating, Release Train Engineers had a sense of ownership.

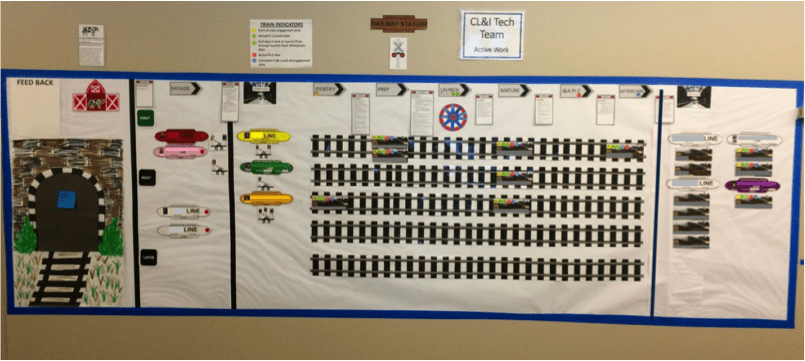

Transformation Railway Station

Northwestern Mutual took a clever twist on the ART program board, dubbing it Transformation Railway Station. On its board, a tunnel image represents the funnel of new work/ideas and cows represent impediments. The former is particularly apt given that, in 1859, two policy owners were killed when a train hit a cow and derailed. When the new company lacked the full funds to pay out those first life insurance claims (for $3500), NWM’s president at the time personally borrowed the funds.

On the board, laminated trains make their way along the track (the Portfolio level) from the departure station through various stages:

- Identify—Communicate change vision, and determine Value Stream, ARTs, scope, PI planning date and training

- Prep—Perform SAFe training

- Launch—Conduct final prep and first PI planning event

- Mature—Coach and develop the ART

- Inspect and Adapt—Hold Inspect and Adapt workshop, plus second PI planning event

- Aftercare—Complete coach strength, weakness, opportunity and threats (SWOT) assessment; discuss future coaching engagement

Through the PI, all parties keep a close watch on progress and metrics. “Leadership can walk up and know where we are at any time,” says Sarah Scott, Agile Lean Organization Coach at Northwestern Mutual.

Cycle Time Improvement

Since deploying SAFe, and beginning its first earnest Agile efforts, Northwestern Mutual reduced Collection Feature Cycle Time by 30-50%. And surveys of business representatives indicate that IT delivers what they requested 80-90 percent of the time.

Ultimately, the changes affected the bottom-line—for the better. “After implementing SAFe, our overall effort actually came in $12 million less than originally estimated and 18 months sooner than predicted,” Kadlec says.

Now in year three, with 12 PIs behind them, the company has five SAFe instances and 14 ARTs in progress across a wide range of product areas. Northwestern Mutual provides leadership for SAFe in Wisconsin, even hosting a Scaling Agile Meetup Group that draws as many as 300 attendees to its monthly gatherings.

“We’re at a tipping point now, continuing to break down barriers,” Schindler says. “The whole organization is in the heart of a major transformation and we’re leveraging SAFe to accelerate our Lean-Agile IT transformation. We’re at a whole other level that I don’t think would have happened as quickly or with as much impact if we’d just had a handful of Scrum teams.”

* Ratings are for The Northwestern Mutual Life Insurance Company and Northwestern Long Term Care Insurance Company, as of the most recent review and report by each rating agency. Northwestern Mutual’s ratings: A.M. Best Company A++ (highest), 5/2016; Fitch Ratings AAA (highest), 11/2016; Moody’s Investors Service Aaa (highest), 1/2017; Standard & Poor’s AA+ (second highest), 6/2016. Ratings are subject to change.

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company (NWM), Milwaukee, WI and its subsidiaries.